Age 3453 | CORNING2019 PROXY STATEMENTDirector Since 2013 | |

Table of Contents

Proposal 1Election of Directors

Age

69

Director Since

1999

Committees ●Audit

●Compensation (Chair)

• Corporate Relations • Nominating and Corporate Governance Current Public and Investment Company Directorships ●None

• Carmichael Investment Partners, LLC Public and Investment Company Directorships Held During the Past 5 Years ●Neustar,• Xtera Communications, Inc. | | | | | |

| | Deborah D. Rieman Retired Executive Chairman, MetaMarkets Group Dr. Rieman has more than 31 years of experience in the software industry. In 2016, she retired as executive chairman of MetaMarkets Group. Previously, she was managing director of Equus Management Company, a private investment fund. From 1995 to 1999, she served as president and chief executive officer of Check Point Software Technologies, Incorporated. Dr. Rieman brings significant expertise in information technology, innovation and entrepreneurial endeavors to the Board and skills related to her Ph.D. in mathematics. She is also the former president and chief executive officer of a software company specializing in security and has experience in technology development, marketing, business development and support, investor relations and investing.

Skills and Qualifications — Expertise in information technology and cyber securitycybersecurity— Experience in technology development, marketing, business development and support, innovation, entrepreneurial endeavors and investing |

| Director Since

2001

1999 | | Committees ●Executive

●Nominating and Corporate Governance (Chair)

• Information Technology Current Public and Investment Company Directorships ●Harris Corporation

●NextEra Energy, Inc.

●Ryder Systems Inc.

• None Public and Investment Company Directorships Held During the Past 5 Years • Neustar, Inc. | | | | | |

| 36 | CORNING 2020 PROXY STATEMENT |

●None

Table of Contents Proposal 1Election of Directors  | | Hansel E. Tookes II Retired Chairman and Chief Executive Officer, Raytheon Aircraft Company Mr. Tookes retired from Raytheon Company in December 2002. He joined Raytheon in 1999 and served as president of Raytheon International, chairman and chief executive officer of Raytheon Aircraft, and executive vice president of Raytheon Company. From 1980 to 1999, Mr. Tookes served United Technologies Corporation as president of Pratt and Whitney’s Large Military Engines Group and in a variety of other leadership positions. Mr. Tookes provides extensive experience in operations, manufacturing, performance excellence, business development, technology-driven business environments, and military and government contracting. He also brings his science and engineering education, training and knowledge to the Board. Mr. Tookes’ industry expertise includes aviation, aerospace and defense, transportation, and technology.

Skills and Qualifications — Extensive experience in global operations, manufacturing, performance excellence, business development, technology-driven business environments, and military and government contracting— Education, training and knowledge in science and engineering— Extensive public company board experience |

CORNING2019 PROXY STATEMENT | 35 |

Table of Contents

Proposal 1Election of Directors

| Director Since

2000

2001 | | Committees ●• Compensation • Executive • Nominating and Corporate Governance (Chair) Current Public and Investment Company Directorships ●Amazon.com,• NextEra Energy, Inc. ●Merck & Co.,• Ryder Systems Inc. Public and Investment Company Directorships Held During the Past 5 Years ●None

• Harris Corporation | | | | | |

| | Wendell P. Weeks Chairman, Chief Executive Officer, and President, Corning Incorporated Mr. Weeks joined Corning in 1983. He was named vice president and general manager of the Optical Fiber business in 1996; senior vice president in 1997; senior vice president of Opto Electronics in 1998; executive vice president in 1999; and president, Corning Optical Communications in 2001. Mr. Weeks was named president and chief operating officer of Corning in 2002; president and chief executive officer in 2005; and chairman and chief executive officer on April 26,in 2007. He added the title of president in December 2010. Mr. Weeks brings deep and broad knowledge of the Company based on his long career across a wide range of Corning’s staff groups and major businesses. In his 37 years with the company, Mr. Weeks has 36 yearsheld a variety of Corning experience including financial, management, business development, commercial, leadership, and general management.management roles. His experiencesleadership in many of Corning’s businesses, andwith numerous technologies, and twelve15 years as chief executive officer have given him a unique understanding of Corning’s diverse business operations and life-changing innovations.

Skills and Qualifications — Wide range of experience including financialglobal business management, business development, commercial leadership, manufacturing, and general managementinnovation— Unique understanding of Corning’s businesses and innovations— Significant public company board experience |

| Director Since

2009

2000 | | Committees ●Audit

●Finance

• Executive (Chair) Current Public and Investment Company Directorships ●Brooks Automation,• Amazon.com, Inc. ●Cabot Corporation

• Merck & Co., Inc. Public and Investment Company Directorships Held During the Past 5 Years • None | | | | | |

| CORNING 2020 PROXY STATEMENT | 37 |

●None

Table of Contents Proposal 1Election of Directors  | | Mark S. Wrighton Professor and Chancellor and Professor of Chemistry,Emeritus, Washington University in St. Louis Dr. Wrighton has more than 26 years of leadership experience overseeing large research universities. Since 1995, Dr. Wrighton has beenHe was elected chancellor and professor of Chemistry at Washington University in St. Louis , a major research university.university in 1995, and served as its chief executive officer for 24 years. Before joining Washington University, he was a researcher and professor at the Massachusetts Institute of Technology, where he was head of the Department of Chemistry from 1987 to 1990, and then provost from 1990 to 1995. Dr. Wrighton served as a presidential appointee to the National Science Board from 2000 to 2006. He is also a past chair of the Association of American Universities, The Business Higher Education Forum, and the Consortium on Financing Higher Education. He was elected to membership in the American Academy of Arts and Sciences and the American Philosophical Society, and he is a Fellow of the American Association for the Advancement of Science. Dr. Wrighton is a professor, chemist and research scientist with expertise in materials and research interests in the areas of transition metal catalysis, molecular electronics and photoprocessesphoto processes at electrodes. He also has expertise in areas of direct relevance to Corning, including materials chemistry, photochemistry, surface chemistry and life sciences. Under Dr. Wrighton’s executive and fiscal leadership, Washington University has grown significantly in academic stature, research enterprise, infrastructure, student quality, curriculum and international reputation. Dr. Wrighton brings to the Board his vast scientific knowledge and understanding of complex research and development issues.

Skills and Qualifications — Deep knowledge in areas of direct relevance to Corning, including materials chemistry, photochemistry, surface chemistry and life sciences— Executive leadership experience, including finance and audit experience— Extensive experience leading institutions with research and development focus— Significant public company board experience | Age 70 | Director Since 2009 | | Committees • Finance • Information Technology (Chair) Current Public and Investment Company Directorships • Brooks Automation, Inc. • Cabot Corporation Public and Investment Company Directorships Held During the Past 5 Years • None | | | | | |

3638 | CORNING2019 2020 PROXY STATEMENT |

Table of Contents

Director Compensation | |  |

Director Compensation The Compensation Committee strives to setsets director compensation at levels that ensure our directors are paid appropriately for their time commitment and responsibilities relative to directors at companies of comparable size, industry and scope of operations. The Committee believes that providing a competitive compensation package is important because it enables Corning to attract and retain highly qualified directors who are critical to the Company’s long-term success. Our objective is to pay non-employee directors competitively compared to the compensation peer group (listed on page 55)comparable companies and to award a significant portion of director compensation in equity. The Compensation Committee’s independent consultant, Frederic W. Cook & Co., Inc., conducts an annual review of the director compensation levels relative to Corning’s compensation peer group and advises the Committee annually to ensure that compensation levels remain competitive. The Company uses a combination of stock-based compensation and cash for its directors. Corning believes it is desirable that a significant portion of director compensation should be linked to the Company’s performance andperformance. Therefore, a portion of the Directors’ compensation is therefore paid inas an annual equity grant of restricted share units, of common stock, which are settled in shares of common stock following retirement or resignation from the Board. To continue to enable the company to attract and incent our Directors, it is important that shareholders approve Corning’s 2019 Equity Plan for Non-Employee Directors, Proposal 4 of this proxy statement. Directors may electdefer receipt of the annual equity retainer restricted share units by electing distribution in up to 10 annual installments and also may defer all or a portion of their cash compensation. AmountsCash amounts deferred may be allocated toto: an account earning interest, compounded quarterly, at the rate equal to the prime rate of Citibank, N.A. at the end of each calendar quarter,quarter; a restricted stock unit account,account; or a combination of such accounts. In 2018,2019, six directors elected to defer some or all of their cash compensation. A cap on director’s compensation of $700,000 per director per year will go into effect upon the approval of Corning’s 2019 Equity Plan for Non-Employee Directors, Proposal 4 of this proxy statement. As an employee of the Company, Mr. Weeks is not compensated separately for service on the Board or any of its Committees. 20182019 Director Compensation

The following table outlines 20182019 director compensation: | Annual Equity Grants | | Each non-employee director annually receives a form of long-term equity compensation approved by the Board. Annual equity grants for non-employee directors are generally approved at the February meeting of the Board. If, however, a director is appointed between the February meeting and December 31, then that director will receive a pro-rata grant shortly after joining the Board. In 2018,2019, our directors’ annual equity compensationgrant was increased from $155,000 to $165,000.$175,000. We issued 5,5335,182 restricted stock units (with a grant date value of approximately $165,000)$175,000) to each non-employee director under our 20102019 Equity Plan for Non-Employee Directors, prorated for Directors joining the Board after February 2018.Directors. These restricted stock units are not available for transfer or sale until six months after the date of a director’s retirement or resignation. | Annual Cash Retainer

Compensation | | $110,000In 2019, our directors’ annual base cash compensation was $110,000 | Lead Independent

Director RetainerCompensation | | Our Lead Independent Director received anreceives additional cash retainercompensation of $35,000. |

| CORNING 2020 PROXY STATEMENT | 39 |

CORNING2019 PROXY STATEMENT | 37 |

Table of Contents Director Compensation Committee Chair Retainer

Compensation | | The Audit Committee Chair andreceives additional cash compensation of $25,000. The Compensation Committee Chair each received anreceives additional cash retainercompensation of $20,000. Other Committee Chairs received anreceive additional cash retainercompensation of $15,000. | Committee Member

RetainersCompensation | | Each Audit Committee member received areceives additional cash retainercompensation of $18,000; each Compensation Committee member received areceives additional cash retainercompensation of $12,000; and each Executive, Finance, Nominating and Corporate Governance, and Corporate Relations Committee member received areceives additional cash retainercompensation of $10,000. |

In 2018,2019, the directors below performed the followingspecified leadership roles: | Name | | Leadership Role | | Mr. Clark | | Lead Independent Director | | Mr. Landgraf | | Audit Committee Chair | | Dr. Rieman | | Compensation Committee Chair | | Dr. Burns | | Corporate Relations Committee Chair | | Mr. Cummings | | Finance Committee Chair | | Mr. Tookes | | Nominating and Corporate Governance Committee Chair |

Non-employee directors are reimbursed for expenses (including costs of travel, food, and lodging) incurred in attending Board, committee, and shareholder meetings. Directors are also reimbursed for reasonable expenses associated with participation in director education programs. Directors’ Charitable Giving Programs Although closed to directors joining the Board after October 5, 2016, Corning has a Directors’ Charitable Giving Program pursuant to which a director may direct the Company to make a charitable bequest to one or more qualified charitable organizations recommended by such director and approved by Corning in the amount of $1,000,000 (employee directors) or $1,250,000 (non-employee directors) following his or her death. This program is either funded directly by the Company or by purchasing insurance policies on the lives of the directors. However, we are under no obligation to use the proceeds of the insurance policies to fund a director’s bequest and can elect to retain any proceeds from the policies as assets of Corning and use another source of funds to pay the directors’ bequests. In 2018,2019, we paid a total of $82,982$68,628 in premiums and fees on such policies for our current directors. Because the charitable deductions and cash surrender value of life insurance policies accrue solely to Corning, the directors derive no direct financial benefit from the program, and we do not include these amounts in the directors’ compensation. Generally, one must have been a director for five years to participate in the program. Directors who had not yet achieved five years’ tenure as of October 5, 2016 will be permitted to participate after five years of Board service. In 2018,2019, Messrs. Blair, Canning, Clark, Cummings, Landgraf, Martin, Tookes and Weeks, Ms. Henretta and Drs. Burns, Rieman and Wrighton were eligible to participate in the program. Directors are also eligible to participate in the Corning Incorporated Foundation Matching Gifts Program for eligible charitable organizations. This Program is available to all Corning employees and directors. The maximum matching gift amount available from the Foundation on behalf of each participant in the Program is $7,500 per calendar year. Corning also pays premiums on our directors’ and officers’ liability insurance policies covering directors.policies. Changes to Director Compensation in 20192020 In February 2019,2020, the Board approveapproved certain changes to director compensation proposed by the Compensation Committee in consultation with the Committee’s independent consultant. Effective January 1, 2019,2020, the non-employee directors’ annual equity grant will increaseincreased from $165,000$175,000 to $175,000.$185,000. As with the 20182019 director equity compensation, this amount will be payable in restricted stock units, which are not available for transfer or sale until six months after the date of a director’s retirement or resignation. In addition, the Audit Committee Chair retainer will increase from $20,000 to $25,000 effective January 1, 2019. 3840 | CORNING2019 2020 PROXY STATEMENT |

Table of Contents Director Compensation 2018

2019 DIRECTOR COMPENSATION TABLE | Name | | Fees Earned or

Paid in Cash(1)

($) | | Stock

Awards(2)

($) | | All Other

Compensation(3)

($) | | Total

($) | | Donald W. Blair | | $ | 138,000 | | $ | 164,994 | | $ | 5,244 | | $ | 308,238 | | Leslie A. Brun(4) | | | 70,000 | | | 82,504 | | | 0 | | | 152,504 | | Stephanie A. Burns | | | 153,000 | | | 164,994 | | | 0 | | | 317,994 | | John A. Canning, Jr. | | | 140,000 | | | 164,994 | | | 7,500 | | | 312,494 | | Richard T. Clark | | | 177,000 | | | 164,994 | | | 7,500 | | | 349,494 | | Robert F. Cummings, Jr. | | | 155,000 | | | 164,994 | | | 0 | | | 319,994 | | Deborah A. Henretta | | | 138,000 | | | 164,994 | | | 0 | | | 302,994 | | Daniel P. Huttenlocher | | | 138,000 | | | 164,994 | | | 0 | | | 302,994 | | Kurt M. Landgraf | | | 170,000 | | | 164,994 | | | 7,500 | | | 342,494 | | Kevin J. Martin | | | 130,000 | | | 164,994 | | | 7,000 | | | 301,994 | | Deborah D. Rieman | | | 160,000 | | | 164,994 | | | 0 | | | 324,994 | | Hansel E. Tookes II | | | 157,000 | | | 164,994 | | | 0 | | | 321,994 | | Mark S. Wrighton | | | 138,000 | | | 164,994 | | | 0 | | | 302,994 |

| Name | | Compensation Earned or

Paid in Cash(1)

($) | | Stock

Awards(2)

($) | | All Other

Compensation(3)

($) | | Total

($) | | Donald W. Blair | | $138,000 | | $174,996 | | $ 7,500 | | $320,496 | | Leslie A. Brun | | 140,000 | | 174,996 | | | | 314,996 | | Stephanie A. Burns | | 153,000 | | 174,996 | | | | 327,996 | | John A. Canning, Jr. | | 140,000 | | 174,996 | | 7,500 | | 322,496 | | Richard T. Clark | | 177,000 | | 174,996 | | 7,500 | | 359,496 | | Robert F. Cummings, Jr. | | 155,000 | | 174,996 | | | | 329,996 | | Deborah A. Henretta | | 138,000 | | 174,996 | | | | 312,996 | | Daniel P. Huttenlocher | | 138,000 | | 174,996 | | 6,250 | | 319,246 | | Kurt M. Landgraf | | 175,000 | | 174,996 | | 7,500 | | 357,496 | | Kevin J. Martin | | 130,000 | | 174,996 | | 7,500 | | 312,496 | | Deborah D. Rieman | | 160,000 | | 174,996 | | | | 334,996 | | Hansel E. Tookes II | | 157,000 | | 174,996 | | | | 331,996 | | Mark S. Wrighton | | 138,000 | | 174,996 | | 7,500 | | 320,496 |

| (1) | Includes all fees and retainersCompensation earned, whether paid in cash or deferred pursuant to the Corning Incorporated Non-Employee Directors’ Deferred Compensation Plan. | | | | (2) | The amounts in this column reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of awards of restricted stock units granted pursuant to the 2010 Equity Plan for Non-Employee Directors. Assumptions used in the calculation of these amounts are included in Note 111 to the Company’s audited financial statements for the fiscal year ended December 31, 20182019 included in the Company’s Annual Report on Form 10-K filed with the SEC on February 12, 2019.18, 2020. There can be no assurance that the grant date fair value amounts will ever be realized. The total number of award shares, RSUs, RSU deferrals and options each Director had outstanding as of December 31, 20182019 is shown in the table below. Total stock holdings for directors as of December 31, 20182019 are shown in the “Beneficial Ownership of Directors and Officers” table. | | | | (3) | The amounts in this column reflect charitable donation matches made by the Corning Incorporated FoundationFoundation’s Matching Gifts Program. | (4) | Mr. Brun’s compensation reflects prorated amounts from July 18, 2018, the date he joined the Board. |

The following are the total number of award shares and restricted stock units (RSUs) and RSU deferrals outstanding each Director had as of December 31, 20182019 | Name | | Award Shares/Units and RSU

Deferrals Outstanding at

December 31, 2018(1) | | Options

Outstanding at

December 31, 2018(2) | | Donald W. Blair | | 55,837 | | 0 | | Leslie A. Brun | | 2,812 | | 0 | | Stephanie A. Burns | | 63,634 | | 0 | | John A. Canning, Jr. | | 100,944 | | 1,323 | | Richard T. Clark | | 53,409 | | 0 | | Robert F. Cummings, Jr. | | 177,792 | | 2,345 | | Deborah A. Henretta | | 60,998 | | 0 | | Daniel P. Huttenlocher | | 25,357 | | 0 | | Kurt M. Landgraf | | 157,087 | | 0 | | Kevin J. Martin | | 42,953 | | 0 | | Deborah D. Rieman | | 111,060 | | 2,345 | | Hansel E. Tookes II | | 98,310 | | 2,345 | | Mark S. Wrighton | | 69,760 | | 2,345 |

| Name | | Award Shares/Units and RSU

Deferrals Outstanding at

December 31, 2019(1) | | Options

Outstanding at

December 31, 2019(2) | | Donald W. Blair | | 65,497 | | 0 | | Leslie A. Brun | | 7,994 | | 0 | | Stephanie A. Burns | | 72,539 | | 0 | | John A. Canning, Jr. | | 110,669 | | 1,323 | | Richard T. Clark | | 58,591 | | 0 | | Robert F. Cummings, Jr. | | 188,003 | | 0 | | Deborah A. Henretta | | 69,314 | | 0 | | Daniel P. Huttenlocher | | 30,539 | | 0 | | Kurt M. Landgraf | | 162,269 | | 0 | | Kevin J. Martin | | 48,135 | | 0 | | Deborah D. Rieman | | 116,242 | | 0 | | Hansel E. Tookes II | | 103,492 | | 0 | | Mark S. Wrighton | | 74,942 | | 0 |

| (1) | This column reflects restricted shares and restricted share units awarded and outstanding or deferred for each Director as of December 31, 2018.2019. | | | | (2) | No options were granted to non-employee directors in 2018.2019. |

| CORNING 2020 PROXY STATEMENT | 41 |

CORNING2019 PROXY STATEMENT | 39 |

Table of Contents Stock Ownership

Information | |  |

Stock Ownership

Information Stock Ownership Guidelines We believe in the importance of equity ownership by directors and executive management as an effectivea direct link to shareholders, and require all directors, named executive officers (NEOs), and non-NEO executive management to achieve the required levels of ownership under our stock ownership guidelines within five years of their election, appointment or designation. Restricted, and direct and indirectly owned shares, and current and deferred restricted stock units, each count toward our stock ownership guidelines. An NEO who falls below the ownership requirement for any reason will have up to three years to return to the required minimum ownership level. All directors and NEOs who have been so for five years or more currently comply with our guidelines. | DIRECTORS | | CEO | | OTHER NEOs | | NON-NEO SENIOR

MANAGEMENT | | | | | | | | 5X

Annual Cash Retainer | | 6X

Base Salary | | 3X

Base Salary | | 1.5X

Base Salary |

Our directors and executive management are also subject to our anti-hedging and anti-pledging policies. For further information, see “Anti-Hedging Policy” and “Anti-Pledging Policy” both on page 56.59. Section 16(a) Beneficial Ownership Reporting Compliance

SEC rules require disclosure of those directors, officers, and beneficial owners of more than 10% of our common stock who fail to timely file reports required by Section 16(a) of the Securities Exchange Act of 1934 during the most recent fiscal year. Based on review of reports furnished to us and written representations that no other reports were required during the fiscal year ended December 31, 2018, all Section 16(a) filing requirements were met.

4042 | CORNING2019 2020 PROXY STATEMENT |

Table of Contents Stock Ownership Information Beneficial Ownership Table | As of December 31, 2018 | | Shares Directly or

Indirectly Owned(1)(2)(3) | | | Stock Options

Exercisable

Within 60 Days | | Restricted Share

Units Vesting

Within 60 Days | | (A)

Total Shares

Beneficially

Owned | | | Percent

of Class | | (B)

Restricted Share

Units Not Vesting

Within 60 Days(4) | | Total of

Columns

(A) + (B) | | The Vanguard Group | | — | | | — | | — | | 62,711,606 | (5) | | 7.83 | | — | | — | | BlackRock, Inc. | | — | | | — | | — | | 53,217,738 | (6) | | 6.60 | | — | | — | | T. Rowe Price Associates, Inc. | | — | | | — | | — | | 43,683,804 | (7) | | 5.40 | | — | | — | | State Street Corporation | | — | | | — | | — | | 40,385,093 | (8) | | 5.00 | | — | | — | | Donald W. Blair | | 17,243 | | | 0 | | 0 | | 17,243 | | | * | | 38,594 | | 55,837 | | Leslie A. Brun | | 0 | | | 0 | | 0 | | 0 | | | * | | 2,812 | | 2,812 | | Stephanie A. Burns | | 49,288 | | | 0 | | 0 | | 49,288 | | | * | | 23,100 | | 72,388 | | John A. Canning, Jr. | | 139,150 | | | 1,323 | | 0 | | 140,473 | | | * | | 51,794 | | 192,267 | | Richard T. Clark | | 41,962 | | | 0 | | 0 | | 41,962 | | | * | | 11,447 | | 53,409 | | Robert F. Cummings, Jr. | | 151,199 | | | 2,345 | | 0 | | 153,544 | | | * | | 113,106 | | 266,650 | | Deborah A. Henretta | | 25,965 | | | 0 | | 0 | | 25,965 | | | * | | 35,033 | | 60,998 | | Daniel P. Huttenlocher | | 13,910 | | | 0 | | 0 | | 13,910 | | | * | | 11,447 | | 25,357 | | Kurt M. Landgraf | | 62,957 | | | 0 | | 0 | | 62,957 | | | * | | 94,130 | | 157,087 | | Kevin J. Martin | | 31,506 | | | 0 | | 0 | | 31,506 | | | * | | 11,447 | | 42,953 | | Deborah D. Rieman | | 100,813 | | | 2,345 | | 0 | | 103,158 | | | * | | 11,447 | | 114,605 | | Hansel E. Tookes II | | 96,863 | | | 2,345 | | 0 | | 99,208 | | | * | | 11,447 | | 110,655 | | Mark S. Wrighton | | 63,743 | | | 2,345 | | 0 | | 66,088 | | | * | | 11,447 | | 77,535 | | Wendell P. Weeks | | 800,371 | (9) | | 488,003 | | 3,182 | | 1,291,556 | | | * | | 246,598 | | 1,538,154 | | R. Tony Tripeny | | 48,939 | | | 102,663 | | 993 | | 152,595 | | | * | | 51,006 | | 203,601 | | James P. Clappin | | 90,836 | | | 36,664 | | 1,065 | | 128,565 | | | * | | 62,750 | | 191,315 | | Lawrence D. McRae | | 137,456 | | | 162,943 | | 1,081 | | 301,480 | | | * | | 66,321 | | 367,801 | | David L. Morse | | 35,953 | | | 72,365 | | 1,033 | | 109,351 | | | * | | 61,830 | | 171,181 | | All Directors and Executive | | | | | | | | | | | | | | | | | | Officers as a group (25 persons) | | 2,162,918 | (10)(11) | | 1,468,167 | | 10,995 | | 3,642,080 | | | * | | 1,214,102 | | 4,856,182 |

| As of December 31, 2019 | | Shares Directly or

Indirectly

Owned(1)(2)(3) | | Stock Options

Exercisable

Within 60 Days | | Restricted Share

Units Vesting

Within 60 Days | | (A)

Total Shares

Beneficially

Owned | | Percent

of Class | | (B)

Restricted Share

Units Not Vesting

Within 60 Days(4) | | Total of

Columns

(A) + (B) | | The Vanguard Group | | — | | — | | — | | 63,137,386 | (5) | 8.20 | % | — | | — | | BlackRock, Inc. | | — | | — | | — | | 53,843,615 | (6) | 7.00 | % | — | | — | | State Street Corporation | | — | | — | | — | | 40,407,846 | (7) | 5.25 | % | — | | — | | Donald W. Blair | | 17,243 | | | | | | 17,243 | | * | | 48,254 | | 65,497 | | Leslie A. Brun | | 0 | | | | | | 0 | | * | | 7,994 | | 7,994 | | Stephanie A. Burns | | 49,288 | | | | 7,600 | | 56,888 | | * | | 24,405 | | 81,293 | | John A. Canning, Jr. | | 139,150 | | 1,323 | | | | 140,473 | | * | | 61,519 | | 201,992 | | Richard T. Clark | | 41,962 | | | | | | 41,962 | | * | | 16,629 | | 58,591 | | Robert F. Cummings, Jr. | | 151,199 | | | | | | 151,199 | | * | | 123,317 | | 274,516 | | Deborah A. Henretta | | 25,965 | | | | | | 25,965 | | * | | 43,349 | | 69,314 | | Daniel P. Huttenlocher | | 13,910 | | | | | | 13,910 | | * | | 16,629 | | 30,539 | | Kurt M. Landgraf | | 62,957 | | | | | | 62,957 | | * | | 99,312 | | 162,269 | | Kevin J. Martin | | 31,506 | | | | | | 31,506 | | * | | 16,629 | | 48,135 | | Deborah D. Rieman | | 100,813 | | | | | | 100,813 | | * | | 16,629 | | 117,442 | | Hansel E. Tookes II | | 96,863 | | | | | | 96,863 | | * | | 16,629 | | 113,492 | | Mark S. Wrighton | | 66,088 | | | | | | 66,088 | | * | | 16,629 | | 82,717 | | Wendell P. Weeks | | 850,823 | (8) | 418,592 | | 2,808 | | 1,272,223 | | * | | 221,740 | | 1,493,963 | | R. Tony Tripeny | | 57,350 | | 128,790 | | 927 | | 187,067 | | * | | 51,641 | | 238,708 | | James P. Clappin | | 103,558 | | 75,856 | | 966 | | 180,380 | | * | | 56,485 | | 236,865 | | Lawrence D. McRae | | 151,242 | | 175,204 | | 978 | | 327,424 | | * | | 58,634 | | 386,058 | | David L. Morse | | 48,617 | | 39,192 | | 940 | | 88,749 | | * | | 54,854 | | 143,603 | All Directors and Executive

Officers as a group

(26 persons) | | 2,300,583 | (9)(10) | 1,301,460 | | 17,622 | | 3,619,665 | | | | 1,196,679 | | 4,816,344 |

| * | Less than 0.50% | | (1) | Includes shares of common stock subject to forfeiture and restrictions on transfer, granted under Corning’s Incentive Stock Plans. | | (2) | Includes shares of common stock subject to forfeiture and restrictions on transfer, granted under Corning’s Restricted Stock Plans for non-employee directors. | | (3) | Includes shares of common stock held by The Bank of New York Mellon Corporation as the trustee of Corning’s Investment Plans for the benefit of the members of the group, who may instruct the trustee as to the voting of such shares. If no instructions are received, the trustee votes the shares in the same proportion as it votes the shares for which instructions were received. The power to dispose of shares of common stock is also restricted by the provisions of the plans. The trustee holds for the benefit of Messrs. Weeks, Tripeny, Clappin, McRae and Dr. Morse, and all executive officers as a group, the equivalent of 12,577,12,900, 0, 2,312, 6,740,2,371, 6,913, 0 and 24,65422,183 shares of common stock, respectively. It also holds for the benefit of all employees who participate in the plans the equivalent of 12,059,56211,138,600 shares of common stock (being 1.52%1.46% of the class). | | (4) | Restricted Share Units represent the right to receive unrestricted shares of common stock upon the lapse of restrictions, at which point the holders will have sole investment and voting power. Restricted Share Units that will not vest within 60 days of the date of this table are not considered beneficially owned for purposes of the table and therefore are not included in the Total Shares Beneficially Owned column because the holders are not entitled to voting rights or investment control until the restrictions lapse. However, ownership of these RSUs further aligns our Directors and Executive Officers’ interests with those of our shareholders. | | (5) | Reflects shares beneficially owned by The Vanguard Group (Vanguard), according to a Schedule 13G/A filed by Vanguard with the SEC on February 11, 2019,12, 2020, reflecting ownership of shares as of December 31, 2018.2019. Vanguard has sole voting power and/or sole dispositive power with respect to 61,552,33161,789,731 shares and shared voting power and/or shared dispositive power with respect to 1,159,275.1,347,655. According to the Schedule 13G/A, Vanguard beneficially owned 7.83%8.20% of our common stock as of December 31, 2018.2019. | | (6) | Reflects shares beneficially owned by BlackRock, Inc. (BlackRock), according to a Schedule 13G/A filed by BlackRock with the SEC on February 2, 2019,5, 2020, reflecting ownership of shares as of December 31, 2018.2019. BlackRock has sole voting power and/or sole dispositive power with respect to 53,217,73853,843,615 shares and shared voting power and/or shared dispositive power with respect to 0 shares. According to the Schedule 13G/A, BlackRock beneficially owned 6.6%7.0% of our common stock as of December 31, 2018.2019. | | (7) | Reflects shares beneficially owned by T. Rowe Price Associates, Inc. (T. Rowe Price), according to a Schedule 13G filed by T. Rowe Price with the SEC on February 14, 2019, reflecting ownership of shares as of December 31, 2018. T. Rowe Price has sole voting power and/or sole dispositive power with respect to 43,683,804 shares and shared voting power and/or shared dispositive power with respect to 0. According to the Schedule 13G, T. Rowe Price beneficially owned 5.4% of our common stock as of December 31, 2018. | (8) | Reflects shares beneficially owned by State Street Corporation (State Street), according to a Schedule 13G filed by State Street with the SEC on February 14, 2019,2020, reflecting ownership of shares as of December 31, 2018.2019. State Street has sole voting power and/or sole dispositive power with respect to 0 shares and shared voting power and/or shared dispositive power with respect to 40,385,093.40,407,846. According to the Schedule 13G, State Street beneficially owned 5.0%5.25% of our common stock as of December 31, 2018.2019. | (9)(8) | Includes 787,794Reflects 837,923 shares held by a revocable trust of which Mr. Weeks is the beneficiary. He currently has no voting authority over these shares. | (10)(9) | Does not include 28,74519,375 shares owned by the spouses and minor children of certain executive officers and directors as to which such officers and directors disclaim beneficial ownership. | (11)(10) | As of December 31, 2018,2019, none of our directors or executive officers have pledged any such shares. |

| CORNING 2020 PROXY STATEMENT | 43 |

CORNING2019 PROXY STATEMENT | 41 |

Table of Contents Proposal 2

Advisory Approval of Executive Compensation

(Say on Pay) | |  |

Proposal 2 Advisory Approval of Executive Compensation

(Say on Pay) Our Board of Directors requests that shareholders approve the compensation of our Named Executive Officers (NEOs), pursuant to Section 14A of the Securities Exchange Act of 1934, as disclosed in this proxy statement, which includes the Compensation Discussion and Analysis, the Summary Compensation Table and the supporting tabular and narrative disclosure on executive compensation. This

While this vote is advisory and not binding on the Company, but the Board of Directors values shareholder opinion and will consider the outcome of the vote in determining our executive compensation programs. Say on Pay Proposal Our Board maintains a “pay for performance” philosophy that forms the foundation for all of the Compensation Committee’s decisions regarding executive compensation. In addition, our compensation programs are designed to facilitate strong corporate governance, foster collaboration and support our short- and long-term corporate strategy.strategies. The Compensation Discussion and Analysis portion of this proxy statement contains a detailed description of our executive compensation philosophy and programs, the compensation decisions the Compensation Committee has made under those programs and the factors considered in making those decisions, including 20182019 Company performance and the direct alignment of pay with performance, focusing on the compensation of our NEOs. Our shareholders have affirmed their support of our programs in our outreach discussions and in last year’stheir ongoing support of our Say on Pay results.proposals. We believe that we have created a compensation program deserving of shareholder support. For these reasons, the Board of Directors recommends that shareholders vote in favor of the resolution: RESOLVED, that on an advisory non-binding basis, the total compensation paid to the Company’s Named Executive Officers (CEO, CFO and three other most highly compensated executives), as disclosed in thethis proxy statement for the 2019 Annual Meeting of Shareholders pursuant to the SEC’s executive compensation disclosure rules including(which includes the Compensation Discussion & Analysis, the Summary Compensation Table, and the supporting tabular and related narrative disclosure on executive compensation,compensation) is hereby APPROVED.   | FOR | Our Board unanimously recommends a vote FOR the advisory approval of our executive compensation as disclosed in this proxy statement. |

4244 | CORNING2019 2020 PROXY STATEMENT |

Table of Contents Compensation Discussion

& Analysis | |  |

Compensation Discussion

& Analysis This Compensation Discussion & Analysis (CD&A) presents Corning’s executive compensation for 2018,2019, including the compensation for our Named Executive Officers (NEOs), and describes how this compensation aligns with our pay for performance philosophy and supports the success of our 2016-2019 Strategy and Capital Allocation Framework. OUR NEOs IN FISCAL YEAR 2019 WERE: OUR NEOs IN FISCAL YEAR 2018 WERE: | | Named Executive Officer | | Role | | Years in Role | | Years at Corning | | Wendell P. Weeks | | Chairman, Chief Executive Officer (CEO) and President | | 1415 Years as CEO

(1213 years as CEO/Chairman) | | 3637 years | | R. Tony Tripeny | | Executive Vice President and Chief Financial Officer | | 34 Years | | 3435 years | | James P. Clappin | | Executive Vice President, Corning Glass Technologies | | 89 Years | | 3940 years | | Lawrence D. McRae | | Vice Chairman and Corporate Development Officer | | 34 Years as Vice Chairman

(1920 years as Corporate Development Officer) | | 3435 years | | David L. Morse | | Executive Vice President and Chief Technology Officer | | 67 Years | | 4344 years |

CD&A Table of Contents To assist shareholdersyou in finding important information, we call your attention to the following sections of the CD&A: Executive Summary

Executive Compensation Philosophy Our compensation program is designed to attract and retain the most talented employees within our industry segments and to motivate them to perform at the highest level while executing on our Strategy and Capital Allocation Framework.strategic framework. In order to retain and motivate this caliber of talent, the Compensation Committee (the Committee) is committed to promoting a performance-based culture. Rewards areCompensation is tied to financial metrics thatdeveloped to incent management to successfully deliver on the Strategy and Capital Allocation Frameworkour strategic framework and our commitments to our shareholders.Our executive compensation is directly aligned with our Company performance. | CORNING 2020 PROXY STATEMENT | 45 |

CORNING2019 PROXY STATEMENT | 43 | |

Table of Contents Compensation Discussion & Analysis Target Total

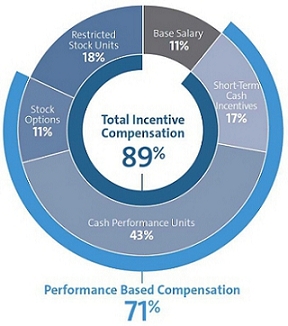

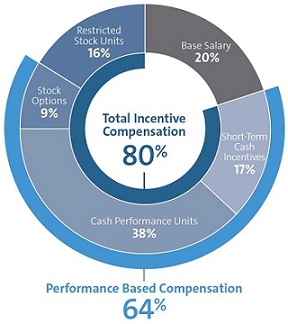

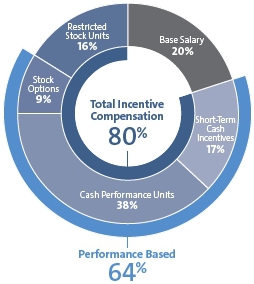

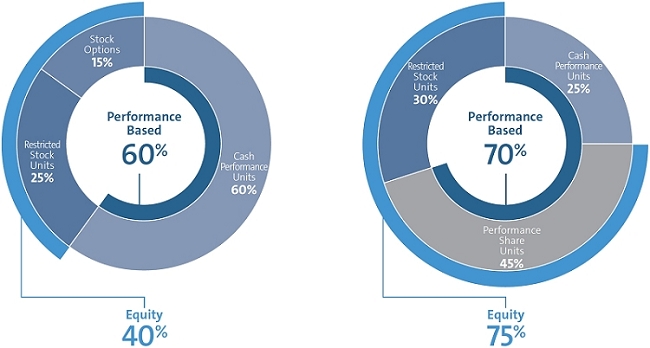

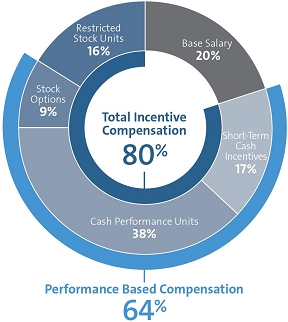

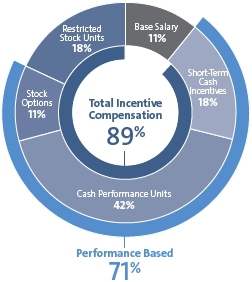

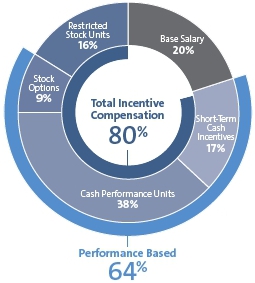

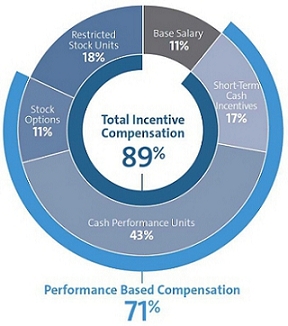

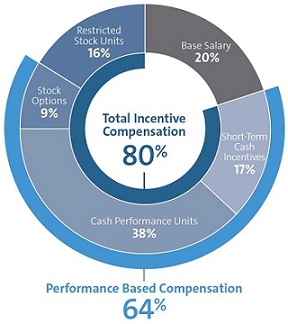

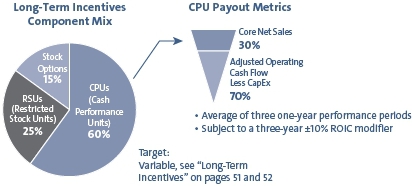

2019 Compensation Components | CEO | | ALL OTHER NEOs |  | |  |

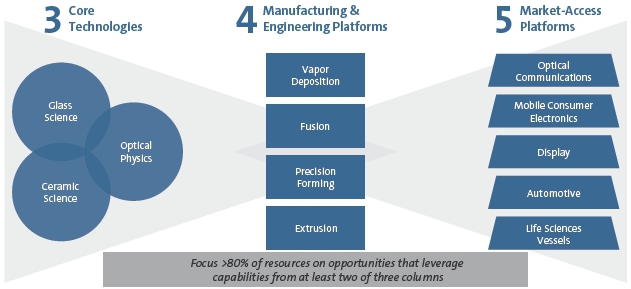

| Our Metrics and Why We Use Them | | | | | | |  Core Earnings per Share (Core EPS): Core EPS is our key measure ofprofitability. Corning generally budgets for share repurchases in establishing its target Core EPS measures. Core Net Sales: Sales growth,both organic through innovation and through acquisitions, is critical to ourshort-andlong-term success. Adjusted Operating Cash Flow: Strong positive cash generation enables ourongoing investment in growth, sustained leadership and returns to shareholders. | |  CapEx: Making good decisions on where and when toinvest for future growthis paramount to our long-term success. Return on Invested Capital (ROIC): We focus on ROIC because it reflects our ability togenerate returns from the capital we have deployed in our operations.The Cash Performance Units (CPUs) payout is increased or decreased up to 10% based on Corning’s ROIC over the three-year performance period. |

Our Short- and Long-Term Incentives | Short-Term Incentives | (Paid in Cash) |  |  |

Long-Term Incentives | (CPU, RSU and Option Awards) |  |

44 | CORNING2019 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis 2018

| Our Short- and Long-Term Incentives | Short-Term Incentives (Paid in Cash) |  |  | | Long-Term Incentives (Paid in Cash and Equity) |  |

2019 Compensation Metrics Our

In 2019, our key compensation metrics are Core Earnings per Share (Core EPS), Core Net Sales and Adjusted Operating Cash Flow less CapEx. These metrics are designed to ensurewere tightly aligned with the successkey financial objectives of our Strategy and Capital Allocation Framework by improvingtargeting improvements in profitability (Core EPS), incenting top line growth (Core Net Sales) and generating, operating cashcashflow (Adjusted Operating Cash Flow less CapEx)flow), and prudent investing for growth (CapEx). | | | CORE EPS | | CORE NET SALES | | ADJUSTED

OPERATING

CASH FLOW LESS CAPEX | 2018 Actual Results | $1.78 | $11,398

million | $926

millionCAPEX | | | | | | | | | | 2018 Score as %2019 Actual Results | | $1.76 | | $11,656 million | | $2,109 million | | $1,978 million | | | | | | | | | | 2019 Performance

of Target PayoutResult | | 116%22%

of target for 20182019 | | 155%31%for PIP

127%for CPUs*

of target for 20182019 | | 128%0%

of target for 20182019 | | 150%

of target for 2019 |

* The payout scales for CPUs and PIP differ; CPUs are capped at 150% and PIP is capped at 200%. Please see page 47 for more information.

Please see “Our 2018 Performance Highlights”2019 Performance” on page 6 for more information about our Core Performance Measures which management uses to measure our business performance and, accordingly, we use for our compensation metrics. Appendix A to this proxy statement forcontains a reconciliation of the non-GAAP measures we use in this proxy statement to the most directly comparable GAAP financial measures. Core Earnings per Share (Core EPS), Core Net Sales and Adjusted Operating Cash Flow are non-GAAP financial measures used by our management to obtain a clearer view of Corning’s operating results.CORNING 2020 PROXY STATEMENT | 47 |

| | Accordingly, these Core Performance Measures form the basis for our compensation performance metrics. |

CORNING2019 PROXY STATEMENT | 45 |

Table of Contents Compensation Discussion & Analysis 2018 Company Performance Overview

In 2018, we utilized our financial strength to continue our focus on innovation, advancing key programs across our market-access platforms to make progress in our Strategy and Capital Allocation Framework.

Highlights of progress across Corning’s market-access platforms include:

●Optical Communications:Secured contracts with industry leaders in the carrier and data center segments that will add significant sales in 2019 and beyond, introduced new products for the hyperscale data center and carrier environments and expanded market access through the acquisition of 3M’s Communication Markets Division

●Mobile Consumer Electronics:Extended the company’s leadership with the launch and adoption of Corning® Gorilla® Glass 6 as well as other cover glass and sensing technology innovations

●Automotive:Gained significant new sales and platform wins for gasoline particulate filters including reaching the production milestone of 1 million GPFs; increased pull for Gorilla Glass for Automotive solutions, particularly the industry’s first AutoGrade™ Glass Solutions for automotive interiors, reaching more than 55 platform wins to date

●Life Sciences Vessels:Increased shipments of Corning Valor® Glass fourfold year over year, indicating progress toward certification across more pharmaceutical companies

●Display:Reached stable returns as the glass pricing environment continued to improve and Corning extended its global leadership by establishing the world’s first Gen 10.5 manufacturing facility

|

Please see “Our 2018 Performance Highlights” on page 6 and “Our Strategy and Capital Allocation Framework” on page 7 for additional information on Corning’s 2018 financial performance. |

2018 Performance and Compensation Alignment

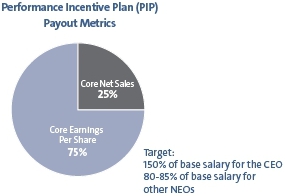

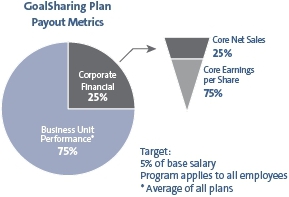

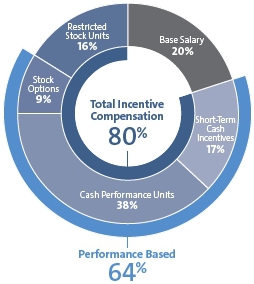

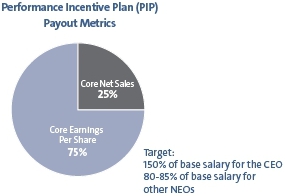

Each year we setour Compensation Committee sets rigorous and challenging performance goals aligned with our strategic objectives. We continue to believe thatThe success of our strategic framework requires top line growth, overall profitability, and the generation of operating cash flow, are the most important measures to the successful execution of our Strategy and Capital Allocation Frameworkprudent investment for growth and delivery of long-term shareholder value. Approximately 89% of the CEO’s target total compensation (excluding employee benefits and perquisites) and 80% of the other NEOs’ target total compensation (excluding employee benefits and perquisites) is variable and depends upon our operating performance or is linked to our stock price. Net profitability and sales growth, both short- and long-term, drive success under our Strategy and Capital Allocation Framework.strategic framework. Accordingly, we have incentive measures linked to both short- and long-term outcomes. Our short-term incentives are cash paymentsbonuses composed of the Performance Incentive Plan (PIP) and the GoalSharing plan. Under each of the PIP, and the GoalSharing plan, Core EPS (75% weight) measures bottom line profitability and Core Net Sales (25% weight) focuses on increasing top line growth. These two financial goals comprisedetermine 100% of PIP payouts for NEOs. ActualIn 2019, actual performance was above thesignificantly below established PIP targets, for 2018, with the blended result being a payout of 126%24% of PIP target.target(significantly lower than the 126% PIP payout in 2018). While 2019 was a challenging year for the Company, this result clearly demonstrates the alignment of our executive compensation with our financial performance. GoalSharing is a company-wide plan that rewards our workforce forbased on the Company’s and Business Unit’srespective business unit’s success by including compensation objectives reflecting a combination of(25% corporate financial (25% weight) andperformance/75% business unit performance (75% weight)weighting as outlined above). NEOs receive payouts based on the weighted average performance of all business unit plans, which resulted in a payout of 6.41%2019 was4.37% of base salary for 2018. 46 | CORNING2019 PROXY STATEMENT |

Tableversus a target of Contents5%(down significantly compared to 6.41% in 2018).

Compensation Discussion & Analysis

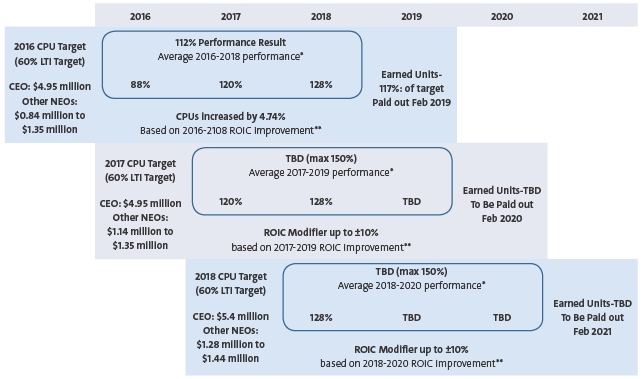

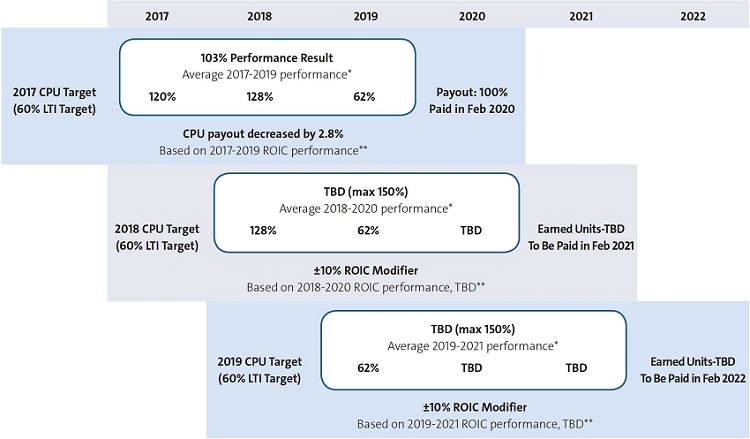

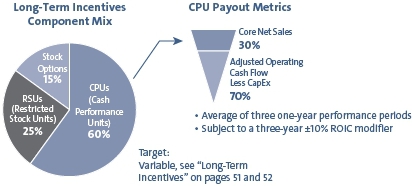

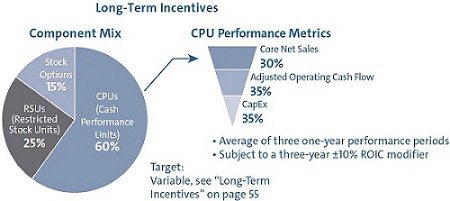

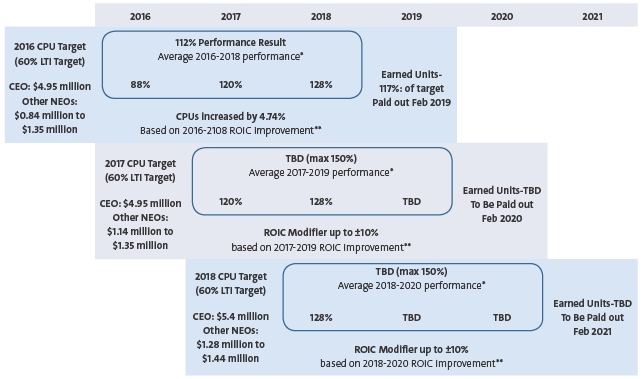

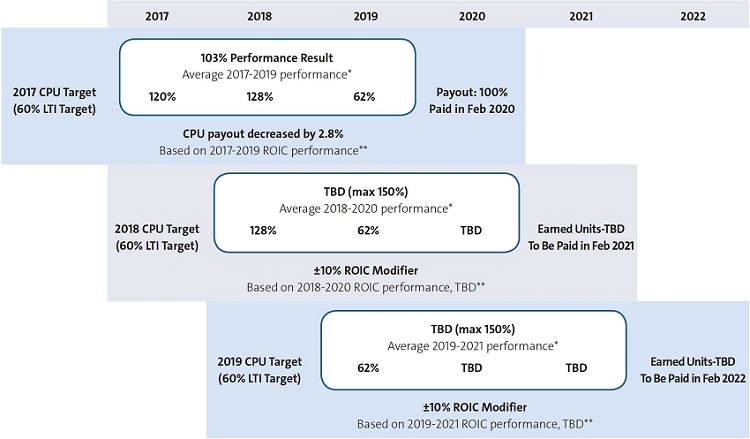

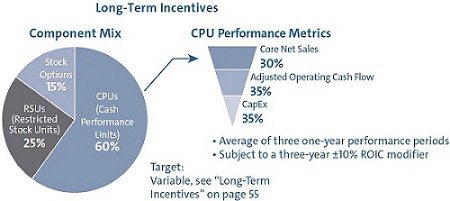

Our Long-Term Incentive (LTI) awards reflectprogram reflects our belief that (1) revenue growth and cash flows and revenue growth enable investments that will sustain our growth over the long term and that the(2) our executives’ interests ofshould aligned with our executives and shareholders should be aligned.shareholders’ interest. LTI awards are comprised of 60% Cash Performance Units (CPUs), 25% Restricted Stock Units (RSUs), and 15% Stock Options. CPU awards are based 70%35% on Adjusted Operating Cash Flow, less35% on CapEx and 30% on Core Net Sales, averaged over a three-year performance period. In addition to the above measures, 2016metrics, 2017 CPUs to be paid in 2020 are subject to an ROIC modifier of up to +/-10% based on ROIC improvementperformance over the three-year period 20162017 through 2018. We implemented this ROIC modifier in response to investor feedback and in support of our Capital Allocation Framework.2019. We define ROIC as core net income before interest, divided by invested capital. Core net income before interest is calculated using constant exchange rates for Japanese yen, NewSouth Korean won, Chinese yuan, new Taiwan dollar, and Chinese yuanthe euro against the U.S. dollar, and a constant tax rate. Invested capital is the sum of total assets excluding foreign currency hedge assets less total liabilities excluding foreign currency hedge liabilities and debt. The 2019 performance result for CPUs (impacting year 3 of the 2017-2019 CPUs, year 2 of the 2018-2020 CPUs and year 1 of the 2019-2021 CPUs) was62% of target. | | While 2019 was a challenging year for the Company, the compensation outcomes clearly illustrate the alignment of our executive compensation with Corning’s financial performance. | | | | | | | | | | PAY FOR PERFORMANCE RESULTS | | | | | | | 2019 | 2018 | | | | PIP payout(% of target) | 24% | 126% | | | | Goalsharing payout(vs. 5% target) | 4.37% | 6.41% | | | | 2019 CPU performance result(% of target) | 62% | 128% | | | | | | | |

2019 Company Performance Overview In 2019, we delivered the commitments of the 2016-2019 Strategy and Capital Allocation Framework. While 2019 was a challenging year financially, we grew sales 2%, had strong performance in three segments, advanced key growth initiatives, and took action to address headwinds in Display Technologies and Optical Communications. However, our 2019 growth did not meet long-term targets and we accelerated actions in our Optical Communications and Display Technologies segments to align production output and working capital to match reduced customer demand, which impacted gross margin. Corning expects to build momentum throughout 2020 that will keep us on track to achieve the goals laid out in our four-year Strategy & Growth Framework. | 48 | CORNING 2020 PROXY STATEMENT |

Table of Contents Compensation Committee approved this ROIC modifier calculationDiscussion & Analysis Despite facing challenges, in early 2016.2019 we made progress across all of our market-access platforms, including: | • | Automotive:Accelerated GPF adoption, driving more than $250 million in 2019 sales; advanced commercialization of AutoGrade™ Glass Solutions with industry leaders across the auto ecosystem, including GAC, Visteon Corporation, LG Electronics, and BOE; ramped manufacturing in Hefei facilities | | • | Optical Communications:Continued to co-innovate with industry leaders to advance 5G and hyperscale data solutions that increase network efficiency – exemplified by new collaborations with Intel, Verizon, CenturyLink, and Altice Portugal; earned global recognition for products including RocketRibbon™ extreme-density cable for hyperscale data centers | | • | Mobile Consumer Electronics:Extended industry leadership with next-generation cover glass solutions and deepened customer commitments, including an additional $250 million investment from Apple, setting the stage for strong adoption of continued innovations | | • | Life Sciences Vessels:Signed commercial agreements with three leading pharmaceutical companies, building on the announcement that a leading pharmaceutical manufacturer received FDA approval of Corning Valor Glass for use as a primary package for a marketed drug product; advanced leadership in key growth categories – cell culture and gene therapy – by innovating and increasing capacity for market-leading solutions | | • | Display:Continued progress toward stable returns; created richer entertainment experiences through display glass innovation; advanced leadership in Gen 10.5 glass, supporting the growth of large-size TVs; Corning display glass price declines remained moderate |

| Please see “Our 2019 Performance” on page 6 and “Successful Completion of our 2016-2019 Strategy and Capital Allocation Framework” on page 7 for additional information on Corning’s 2019 financial performance. |

The following table compares the 2018our 2019 actual results andwith our targeted goals for each performance measure compared with 2017.2018. | | 2018 | | 2017 | | Measure | | Actual and

% increase

vs. ’17 Actual | | Target and

% increase

vs. ’17 Actual | | Actual | | Target | | Core EPS | | $1.78 | | $1.74 | | $1.60 | | $1.57 | | Percentage increase vs ’17 Actual | | +11.9% | | +8.8% | | | | | | Core Net Sales (millions) | | $11,398 | | $11,028 | | $10,258 | | $9,945 | | +11.5% | | +7.5% | | | | | | Adjusted Operating Cash Flow | | $926 | | $696 | | $816 | | $756 | | less CapEx (millions) | | N/A(1) | | N/A(1) | | | | |

| | | 2019 | | 2018 | | Measure | | Actual and

% increase

vs. ’18 Actual | Target and

% increase

vs. ’18 Actual | | Actual | Target | | Core EPS | | $1.76 | $1.96 | | $1.78 | $1.74 | | Percentage increase vs ’18 Actual | | -1.1% | +10.2% | | | | | Core Net Sales (millions) | | $11,656 | $12,298 | | $11,398 | $11,028 | | | +2.3% | +7.9% | | | | Adjusted Operating Cash Flow

(millions)

CapEx (millions)(2) | | $2,109 | $2,700 | | $3,168 | N/A(2) | | | N/A(1) | N/A(1) | | | | | | $1,978 | $2,350 | | $2,242 | N/A(2) | | | N/A(1) | N/A(1) | | | |

| (1) | Adjusted Operating Cash Flow lessand CapEx goals are established yearly, independent of the prior year. | | | | (2) | 2019 was the first year that a separate goal was established for Adjusted Operating Cash Flow and CapEx. |

Please see “Our 2018 Performance Highlights” on page 6 for more information about our Core Performance Measures and Appendix A to this proxy statement for a reconciliation of the non-GAAP measures we use in this proxy statement to the most directly comparable GAAP financial measures. In 2018, Corning used constant currency rates for the Japanese yen of ¥107:$1, for the New Taiwan dollar of NT$31:$1, for the Chinese yuan of ¥6.7:$1 and for the South Korean won of ₩1,175:$1, and restated all prior periods to these constant currency rates for comparability purposes. For additional information about our Core Performance Measures, please see page 6. Our rigorous goal setting process is demonstrated by the following payout scale for our short- and long-term incentive plans:

| | | | Short Term/Annual Incentive

2018 PIP Measures | | Long-Term Incentive

2018 CPU Measures

(Year Three of 2016-2018 Plan) | | | | | Core EPS Goal

(Weighted 75%) | | Core Net Sales Goal

(Weighted 25%) | | Adjusted Operating Cash

Flow less CapEx Goal (Weighted 70%) | | Core Net Sales Goal

(Weighted 30%) | | | Payout % | | Core

EPS | | Growth

(over

prior year) | | Core Net

Sales

(in $M) | | Growth

(over

prior year) | | Adjusted

OCF less

CapEx (in $M) | | % of

2018 Plan | | Core Net

Sales

(in $M) | | % of

2017

Core Net

Sales | | | 200% | | $1.96 | | 22.8% | | $11,490 | | 12.0% | | Capped at 150% | | | 150% | | 1.89 | | 18.6% | | 11,387 | | 11.0% | | $1,096 | | 157.5% | | $11,490 | | 12.0% | | | 125% | | 1.81 | | 13.4% | | 11,205 | | 9.2% | | 896 | | 128.7% | | 11,387 | | 11.0% | | TARGET | | 100% | | 1.74 | | 9.4% | | 11,028 | | 7.5% | | 696 | | 100.0% | | 11,028 | | 7.5% | | | 75% | | 1.64 | | 2.7% | | 10,601 | | 3.3% | | 496 | | 71.3% | | 10,601 | | 3.3% | | | 50% | | 1.60 | | 0.5% | | 10,387 | | 1.3% | | 429 | | 61.7% | | 10,387 | | 1.3% | | | 0% | | 1.42 | | -10.7% | | 10,054 | | -2.0% | | 296 | | 42.5% | | 10,054 | | -2.0% |

OUR RIGOROUS GOAL SETTING PROCESS IS DEMONSTRATED BY THE FOLLOWING TARGETS AND PAYOUT SCALE FOR OUR SHORT- AND LONG-TERM INCENTIVE PLANS: | | | | | Short Term/Annual Incentive

2019 PIP Measures | | Long-Term Incentive 2019 CPU Measures

(Year Three of 2017-2019 Plan) | | | | | | Core EPS Goal

(Weighted 75%) | | Core Net Sales Goal

(Weighted 25%) | | Adjusted Operating Cash

Flow Goal (Weighted

35%) | | CapEx

(weighted 35%) | | Core Net Sales Goal

(Weighted 30%) | | | | Payout % | | Core

EPS | | Growth

(over

prior year) | | Core Net

Sales

(in $M) | | Growth

(over

prior year) | | Adjusted

OCF (in $M) | | % of

2019 Plan | | CapEx

(in $M) | | % of

2019 Plan | | Core Net

Sales

(in $M) | | % of

2018

Core Net

Sales | | | | 200% | | $ 2.19 | | 22.8% | | $ 12,895 | | 13.1% | | Capped at 150% | | | | 150% | | 2.13 | | 19.8% | | 12,746 | | 11.8% | | $3,000 | | 111.1% | | $ 2,100 | | 89.4% | | $ 12,895 | | 13.1% | | | | 125% | | 2.07 | | 16.4% | | 12,581 | | 10.4% | | 2,875 | | 106.5% | | 2,163 | | 92.0% | | 12,746 | | 11.8% | | TARGET | | 100% | | 1.96 | | 10.2% | | 12,298 | | 7.9% | | 2,700 | | 100.0% | | 2,350 | | 100.0% | | 12,298 | | 7.9% | | | | 75% | | 1.86 | | 4.2% | | 12,007 | | 5.3% | | 2,541 | | 94.1% | | 2,517 | | 107.1% | | 12,007 | | 5.3% | | | | 50% | | 1.81 | | 1.9% | | 11,804 | | 3.6% | | 2,494 | | 92.4% | | 2,544 | | 108.3% | | 11,804 | | 3.6% | | | | 0% | | 1.68 | | -5.6% | | 11,398 | | 0.0% | | 2,400 | | 88.9% | | 2,600 | | 110.6% | | 11,398 | | 0.0% |

| We align rigorous financial goals and compensation targets to drive significant year-over-year performance. |

| CORNING 2020 PROXY STATEMENT | 49 |

CORNING2019 PROXY STATEMENT | 47 |

Table of Contents Compensation Discussion & Analysis ROIC Modifier In 2016, based on investor feedback and in support of our Strategy and Capital Allocation Framework, the Compensation Committee added a three-year ROIC modifier to CPUs.the CPUs in our LTI Plan. With this modifier, the CPU payout may be increased or decreased up to 10% based on ROIC performance over the three-year performance period. For the 2016-20182017-2019 performance period, the ROIC improvement target was established at 250100 basis points, which the Committee believed was challenging but achievable through continued strong operating performance. The setting of this target reflected the multi-year operating plan for the companyCompany and management’s assessment of future Company performance. The ROIC modifier for 20162017 CPUs (based on 20162017 through 20182019 performance) was as follows: ROIC Improvement

2016 – 2018

(in basis points) | | Modifier (Adjustment to 2016 CPUs) | | 250 | | +10% | | 175 | | +5% | | 100 | | No adjustment | | 50 | | -5% | | 0 | | -10% |

ROIC Improvement

2017 – 2019

(in basis points) | | Modifier (Adjustment to 2017 CPUs) | | 250 | | +10% | | 175 | | +5% | | 100 | | No adjustment | | 50 | | -5% | | 0 | | -10% |

From 20162017 to 2018,2019, ROIC improved 17472 basis points, resulting in a +4.74% increase 2.8% decreaseto the 20162017 CPU payout made in 2019.2020. Results for Short Term Incentives and the 2016-2018 LTI

2019 Compensation Plan Payout Percentages The following table reflects our 2019 compensation plan’s payout percentages based on our 2019 financial performance: | Short Term Incentives | PERFORMANCE INCENTIVE PLAN (PIP)

100% CORPORATE FINANCIAL PERFORMANCE | | Components | | Weighting | | % of target

earned | | Core EPS | | 75% | | 116% | | Core Net Sales | | 25% | | 155% | | 2018 performance result | | | | 126% | | | GOALSHARING – 25% CORPORATE PERFORMANCE,

75% BUSINESS UNIT PERFORMANCE | | Components | | | | % of base

salary earned | | Corporate financial performance — | | | | | | 1.25% target × 126% performance | | | | | | (See PIP above) | | 25% | | 1.58% | | Average Business Unit Performance | | 75% | | 4.83% | | 2018 performance result | | | | 6.41% |

| Long Term Incentives | CASH PERFORMANCE UNITS

(60% OF LTI TARGET – OTHER 40% ARE RSUs AND OPTIONS) | | Components | | Weighting | | % of target

earned, 2018

performance

year | | Operating Cash Flow less CapEx | | 70% | | 128% | | Core Net Sales | | 30% | | 127% | | 2018 performance result | | | | 128% | | | | 2016-2018 CPU PERFORMANCE RESULTS | | Components | | | | % of target

earned,

2016-2018

performance | | 2016 performance result | | | | 88% | | 2017 performance result | | | | 120% | | 2018 performance result | | | | 128% | | 2016-2018 average performance | | | | 112% |

| Short Term Incentives | | | | | | PERFORMANCE INCENTIVE PLAN (PIP) | | | 100% CORPORATE FINANCIAL PERFORMANCE | | | | | | | % of target | | Components | | Weighting | | earned | | Core EPS | | 75% | | 22% | | Core Net Sales | | 25% | | 31% | | 2019 payout | | | | 24% | | | | | | | | GOALSHARING – | | | | | | 25% CORPORATE PERFORMANCE, 75% BUSINESS UNIT PERFORMANCE | | | | | | | | | | | | % of base | | Components | | | | salary earned | | Corporate financial performance — | | | | | | 1.25% target × 24% performance | | | | | | (See PIP above) | | 25% | | 0.30% | | Average Business Unit Performance | | 75% | | 4.07% | | 2019 payout | | | | | | (vs. 5% target) | | | | 4.37% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Long Term Incentives | | | | | | CASH PERFORMANCE UNITS | | | | | | (60% OF LTI TARGET – OTHER 40% ARE RSUs AND OPTIONS) | | | | | | % of target | | | | | | earned, 2019 | | | | | | performance | | Components | | Weighting | | year | | Operating Cash Flow | | 35% | | 0% | | CapEx | | 35% | | 150% | | Core Net Sales | | 30% | | 31% | | 2019 blended performance result | | | | 62% | | | | | | | | 2017-2019 CPU PERFORMANCE RESULTS | | | | | | % of target | | | | | | earned, | | | | | | 2017-2019 | | Components | | | | performance | | | | | | | | | | | | | | 2017 performance result | | | | 120% | | 2018 performance result | | | | 128% | | | | | | | | 2019 performance result | | | | 62% | | 2017-2019 average performance | | | | 103% |

2016-2018 2017-2019

average performance | × | ROIC

Modifier

of -2.8% | = | Final percentage% payout of 2017

target amount of 2016 CPUs to be paid in 2018 | 112%103% × 4.74%97.2% =100%117% |

48Following two strong years, our 2019 financial performance fell well short of our targets and our compensation payouts reflect that shortfall. |

| 50 | CORNING2019 2020 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis

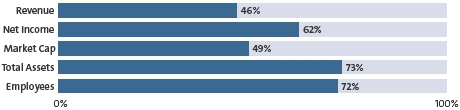

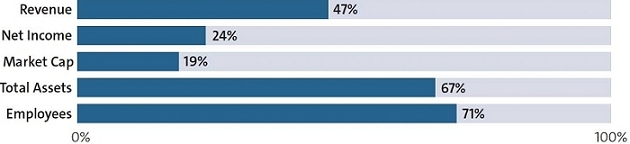

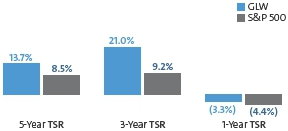

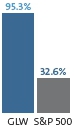

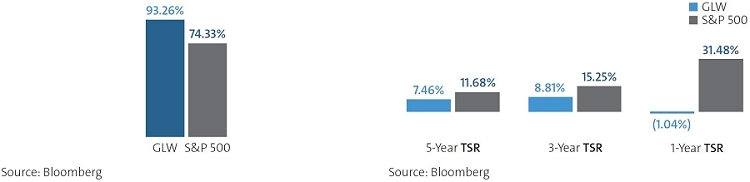

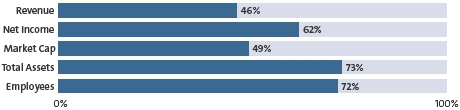

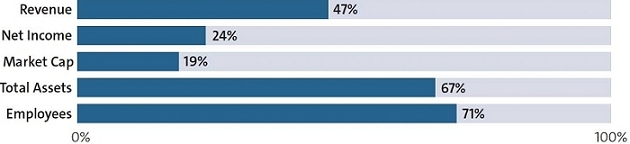

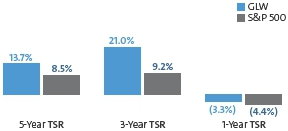

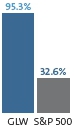

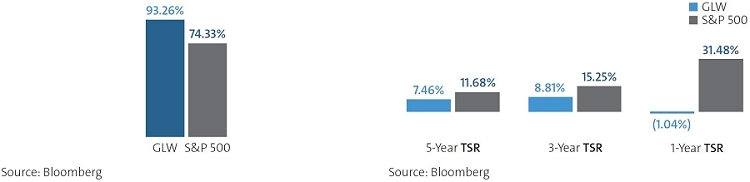

Total Shareholder Return Corning’s Total Shareholder Return (TSR), which consists of stock price appreciation and reinvestment of common dividends, outperformed the S&P 500 Index over the lastis shown below for 1, 3 and 5 year periods. The financial challenges of 2019 significantly impaired our 1-, 3-, and 5-year periods asTSR results.In the first three years of year-end 2018. Since the introduction of our 2016-2019 Strategy and Capital Allocation Framework, we haveTSR significantly outperformed the S&P 500 Index by nearlyIndex;however, 2019 TSR performance was disappointing as a result of headwinds in Display Technologies and Optical Communications. Nevertheless, we had strong performance in three timessegments, grew sales 2%, advanced key growth initiatives, and took action to address headwinds in termsthe segments mentioned above. Although 2019 was a challenging year, our compensation outcomes demonstrate the direct alignment of total shareholder return.our executive compensation program with the Company’s performance. The Strategy and Capital Allocation Framework has paid off from a financial perspective.

Between its inception in October 2015 and year-end 2018, Corning had TSR of approximately

95% vs. less than 35% for the S&P 500. |

ANNUALIZED TOTAL SHAREHOLDER RETURN | | TOTAL SHAREHOLDER RETURN SINCE START OF FRAMEWORK | | ANNUALIZED TOTAL SHAREHOLDER RETURN | As of year-end 2018 | | October 21, 2015 through year-end 20182019 | | As of year-end 2019 |  | |  | Source: Bloomberg

| | Source: Bloomberg

|

Shareholder Engagement At our 2018 annual meeting of shareholders, our Say on Pay proposal received support from | 90% | of votes cast. |

Strong Say on Pay Results.At our 20182019 Annual Meeting of shareholders, our Say on Pay proposal received support from 90%94% of votes cast. We have received 90% or greater support for our Say on Pay proposal each of the past three years. We view this level of shareholder support as an affirmation of our current pay practices and pay for performance philosophy.

Shareholder Outreach.In 2018, as part of our shareholder outreach program,2019, we met with shareholders representing approximately 45% of our outstanding shares, and approximately two-thirds of our top fifty shareholders. In these meetings, we discussedAdditionally, executive management, Board members, Investor Relations and the Corporate Secretary engage annually with the governance teams of our Strategylargest investors to understand their perspectives on a variety of matters, including executive compensation, risk oversight, corporate governance policies and Capital Allocation Framework (SCAF), as well as governance, compensation, human capital management andcorporate sustainability matters. practices. We learned through these meetingsthatmeetings that our investors are pleased with the SCAFour strategic framework and believe we have clearly articulated how it creates shareholder value and how it is connected to management compensation at Corning.compensation. These shareholders also were generally supportive of our executive compensation program, the direct linkage of financial metrics in our performance-based variable compensation plans to the SCAF,our strategic framework, and the addition of the ROIC modifier that was implemented in 2016 in response to investor feedback. As in previous years, shareholders were not prescriptive about compensation plan design. Instead, they were more interested to see that the results and outcomes delivered by the incentive plans were aligned appropriately with Corning’s performance and had appropriately incented our executives to deliver on our SCAF.strategic framework. We also communicate with shareholders through a number of routine forums, including quarterly earnings presentations, U.S. Securities and Exchange Commission (“SEC”) filings, the Annual Report and Proxy Statement, the annual shareholder meeting, investor meetings and conferences and web communications. We relay shareholder feedback and trends on corporate governance and sustainability developments to our Board and its Committees and work with them to both enhance our practices and improve our disclosures. | CORNING 2020 PROXY STATEMENT | 51 |

CORNING2019 PROXY STATEMENT | 49 |

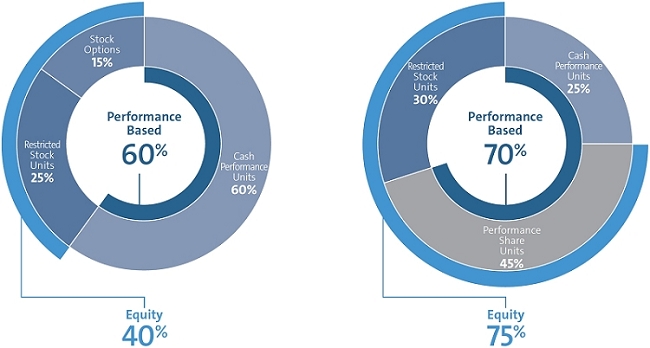

Table of Contents Compensation Discussion & Analysis What’s Coming in 2020 Compensation Program Design Although our shareholders are generally supportive of our executive compensation program, they have provided feedback which has influenced refinements to our Executive Compensation program design in 2020. What we heard from shareholders... | | What we did... | | Shareholdersliked the 3-year ROICmodifier linked to the SCAF | | In 2016 we introduced a three-year +/-10% ROIC modifier to the CPUsin our Long-Term Incentive Plan.For 2020 we haveincreased theweighting of the three-year modifier to +/-25% and added additionalmetrics, to tightly align with the long-term goals of the new Strategy &Growth Framework. (See chart below) | | Shareholderslike the alignment ofexecutive compensationwith thestrategic frameworks | | The key performance measures for our variable compensation programsare to increase revenues and EPS and generate operating cash flow whilecarefully managing our CapEx | | | | | | Beginning in 2020, the LTI modifier will include targets for three-yearROIC, Operating Margin and Operating Cash Flowto tightly align with thelong-term goals of the new Strategy & Growth Framework | | Shareholders wanted to seemoreequity and less cashin the executiveLong-Term Incentive Plan | | Beginning in 2020, weincreased the equity componentin our LTI Plan by 88%(from 40% to 75%) of an executive’s annual target opportunity (see chart below) |

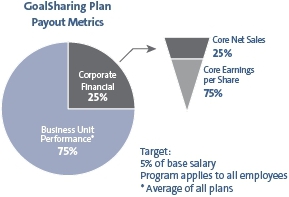

2019 LTI vs. 2020 LTI | 2019 LTI Mix | | 2020 LTI Mix |  |

| 40% EQUITY / 60% CASH | | 75% EQUITY / 25% CASH | | CPU Payment Metrics: | | CPU/PSU Payout Metrics: | | • | 30% Core Net Sales | | • | 33.3% Core Net Sales | | • | 35% Adjusted Operating Cash Flow | | • | 33.3% Adjusted Operating Cash Flow | | • | 35% CapEx | | • | 33.3% CapEx | | • | Average of three one-year performance periods | | • | Average of three one-year performance periods | | • | Subject to a +/-10% modifier linked to ROIC improvement | | • | Subject to a +/-25% modifier linked to ROIC and Operating Margin improvements and cumulative three-year Operating Cash Flow |

| 52 | CORNING 2020 PROXY STATEMENT |

Table of Contents Compensation Discussion & Analysis | Robust Compensation Program Governance | | Corning has rigorous and robust governance with respect to its executive compensation plan: | ✓ Close alignment of pay with performance over both the Close alignment of pay with performance over both the shortshort- and long-term horizon, and delivery of the goals of our Strategy and Capital Allocation Frameworkstrategic framework

✓Mix of cash and equity incentives tied to short-term financial performance and long-term value creation

✓CEO total compensation targeted within a competitive range of the Compensation Peer Group median

✓Caps on payout levels for annual incentives in a budgeted down-cycle year

✓Significant NEO share ownership requirements

✓Anti-hedging and pledging policies

✓Clawback policy applicable to both cash and equity compensation

✓Minimum 3-year vesting period for restricted stock or restricted stock unit awards in employee equity plan | |

✓Independent compensation consultant advisor to the Compensation Committee

✓History of demonstrated responsiveness to shareholder concerns and feedback, and ongoing commitment to shareholder engagement

✓Limited and modest perquisites that have a sound benefit to the Company’s business

✕No tax gross-ups or tax assistance on perquisites

✕No repricing or cash buyout of underwater stock options without shareholder approval

✕No excise tax gross-ups for officer agreements entered into after July 2004

|

20182019 Executive Compensation Program Details

Our key compensation program principles are as follows: ●• | Provide a competitive base salary | | | | ●• | Pay for performance | | | | ●• | Incent executionsuccessful completion of our 2016-2019 Strategy and Capital Allocation Framework | | | | ●• | Apply a team-based management approach | | | | ●• | Increase the proportion of performance-based incentive compensation for more senior positions | | | | ●• | Align the interests of our executive group with shareholders |

Base Salary Base salaries provide a form of fixed compensation and are reviewed annually by the Committee, which considers internal equity and individual performance, as well as competitive positioning, as discussed in the “Compensation Peer Group” section starting on page 54.58. In 2018,2019, Mr. Weeks’ base salary increased by 3%3.25%, consistent with the salary increase budget for all other U.S. salaried employees. Mr. Tripeny received a base salary increase of 15% as part of a multi-year strategy to better align his overall compensation package to comparable external salary benchmarks as he continues to demonstrate strong performance as CFO. Base salaries of the remaining NEOs also increased by 5.5% as a result of strong performance and to align compensation with both internal and external salary benchmarks as the Company grows. 50 | CORNING2019 PROXY STATEMENT |

Table of Contents3.25% in 2019.

Compensation Discussion & Analysis

Short-Term Incentives Short-term incentives are designed to reward NEOs for Corning’s consolidated annual financial performance supporting our Strategy and Capital Allocation Frameworkstrategic framework and team-based management approach. Corning has two short-term incentive plans: the Performance Incentive Plan (PIP) and GoalSharing. | CORNING 2020 PROXY STATEMENT | 53 |

Table of Contents Compensation Discussion & Analysis PIP targets are individually established by the Committee each February as a percentage of the NEO’s year-end salary depending on the competitive marketplace and his or her level of experience. In 2018,2019, Mr. Weeks’ PIP target iswas unchanged at 150% of year-end base salary. Mr. McRae’s PIP target iswas 85% of year-end base salary and other NEOs havehad PIP targets of 80%. PIP goalstargets are approved in February and payments are made by the following March 15 once the performance results are known. As outlined on page 48,50, the 20182019 PIP payout will be 126%24% of target based on performance achievement above the pre-establishedwhich was well below 2019 targets. GoalSharing is designed to motivate employees to work together to achieve the most critical goals in each business unit. All Corning employees are eligible for GoalSharing with a target generally equal to 5% of base salary. Earned GoalSharing may be 0% - 10% of base salary, and is weighted 25% on corporate financial performance and 75% on business unit performance. The NEOs’ GoalSharing is based 25% on corporate financial performance and 75% on the average of the results of all business unit plans. GoalSharing goals are approved in February each year and paymentpayments are made by the end of the following February once the performance results are known. As outlined on page 48,51, the 20182019 GoalSharing payout will be 6.41%for our NEOs was 4.37% of year-end base pay due to achievement above the pre-established targets.versus a target of 5%.

Long-Term Incentives Long-Term Incentives (LTI) are comprised of cash and equity in the form of CPUs, RSUs, and stock options (Options). We believe it is important to link LTI amountsmetrics to financial measures that supportwill drive the executionsuccess of our Strategy and Capital Allocation Frameworkstrategic framework and generate long-term value for our shareholders. We also believe it is important for a significant portion of LTI to be in the form of equity to align our executives’ stock ownership interests with those of our shareholders. LTI targets are established by the Committee for each NEO annually in February. Mr. Weeks’ 20182019 LTI target is $9was $9.75 million. Other NEOs’ targets may be found in footnote 3 to the Summary Compensation Table on page 5862 and range from $2.125$2.35 million to $2.4$2.55 million. ●• | CPUsrepresent 60% of the annual target LTI target.value. Payout is based on cash generation and revenue growth, growth—measures that support our Strategy and Capital Allocation Frameworkstrategic framework as well as our long-term financial health and success. The performance measures for CPUs are 1) Adjusted Operating Cash Flow less CapEx (70%(35%), which aligns the cash flow goal to our capital allocation plan, and2) CapEx (35%) which maintains focus on our CapEx,prudent investment decisions and 2)3) Core Net Sales (30%). Actual CPUs earned are based on the averageactual performance averaged over a three-year period. CPUs awarded in 2018 are2019 were also subject to a three-year ROIC modifier of up to ±10% to further align compensation earned with the goal of our 2016-2019 Strategy and Capital Allocation Framework to improve our corporate ROIC. Accordingly, CPUs earned for the years 2018-20202019-2021 will be paid out (in 2021) subject to an adjustment of up to ±10%, depending2022) based on Corning’s ROIC performance over the three-year performance period compared to a pre-established performance target.goals. | | | | ●• | RSUsrepresent 25% of the annual target LTI value. The number of RSUs granted is determined based on the closing stock price on the first business day of April, and awards cliff vest approximately three years from the grant date. | | | | ●• | Optionsrepresent 15% of the annual target LTI value. The number of Options granted is determined using a Black-Scholes valuation. Options were granted on the first business day of April. Vesting is three years after the grant date, and the option awards have a maximum ten-year term. |

| 54 | CORNING 2020 PROXY STATEMENT |

CORNING2019 PROXY STATEMENT | 51 |

Table of Contents Compensation Discussion & Analysis Long-Term Incentives – Cash Component

| * | Performance targets are established in February each year for the calendar year. See page 48pages 49 and 50 for 20182019 performance measures and results | | | | ** | 3-year ROIC improvement target is established at the beginning of each 3-year performance period. See page 4851 for 2016-20182017-2019 performance measuremeasures and results |

2018

2019 Long-Term Incentives – Equity Components

| Compensation

Component | Target

Opportunity | Number of

Units/Options Granted | Vesting

Period | Value

Realized | Restricted

Stock

Units (RSUs) | CEO:

$2.25 million

Other NEOs:

$0.53 million to

$0.6 million

| 25% of LTI target, based onthe closing price of Corning’scommon stock on the grantdate (April 2, 2018)1, 2019) | Approximately

3 years | Dependent upon Corningcommon stock price on thevesting date | Stock

Options | CEO:

$1.35 million

Other NEOs:

$0. 32 million to

$0.36 million

| 15% of LTI target, based onthe Black Scholes Valuationat the time of the grant (April 2, 2018)(April 1, 2019) | 3 years | Dependent upon Corningcommon stock price increase,if any, between time ofthe grant and the time ofexercise |

52 | CORNING2019 PROXY STATEMENT |

| CORNING 2020 PROXY STATEMENT | 55 |

Table of Contents Compensation Discussion & Analysis

CEO Target Compensation Over the past fourteenfifteen years, under the leadership of Mr. Weeks, Corning has grown significantly, achieved the lowest cost position and market leadership in many key businesses, and created new-to-the-world product categories, such as Corning®Gorilla®Glass, heavy-duty diesel substrates and filters, customized fiber-to-the-home solutions and Corning Valor®Glass. Based on

In recognition of this sustained leveltrack record of performance and particularly strong performance results in 2017 and 2018 in February 2018,2019, the Compensation Committee approved a 3%3.25% base salary increase for Mr. Weeks and an increase inincreased Mr. Weeks’ LTI target to $9$9.75 million. ●• | Base salary– increased by 3%3.25%, in line with base salary increases for all other U.S. based salaried employees. | ● | | | • | Short-Term Incentives Target–remained flat at 155% of base salary, comprised of a PIP target of 150% of base salary and a GoalSharing target of 5% of base salary. | ● | | | • | Long-Term Incentives Target– increased to $9$9.75 million from $8.25$9 million |

Eighty-nine

Year-over-year, eighty-nine percent of Mr. Weeks’ pay is directly tied to Corning’s operating performance and stock price. As a result, Mr. Weeks’ year over year compensation in 2019 is significantly below that of 2018. The table below shows annual CEO pay (i.e., salary and incentive compensation) for 2018 and 2019, excluding employee benefits, perquisites and the change in pension value, which can fluctuate significantly year-to-year solely due to discount rate changes.

CEO COMPENSATION | | 2018 | | 2019 | | Percent Change | | Base | $1,412,769 | | $1,457,604 | | +3.2% | | Goalsharing | 91,996 | | 64,755 | | -29.6% | | PIP | 2,712,528 | | 533,448 | | -80.0% | | CPUs | 6,692,386 | | 3,365,442 | | -49.7% | | RSUs | 2,250,004 | | 2,437,491 | | +8.3% | | Stock Options | 1,068,905 | | 1,262,629 | | +18.1% | | Total Compensation (excluding pension and all other compensation) | $14,228,588 | | $9,121,369 | | -35.9 |

Employee Benefits and Perquisites